The Guarantee Product What is it? There are 3 parties in the Credit Guarantee Program:

- The Borrower - the SME / entrepreneur

- The Lender – the financial institution

- The Guarantor – the agency

How does this operate?

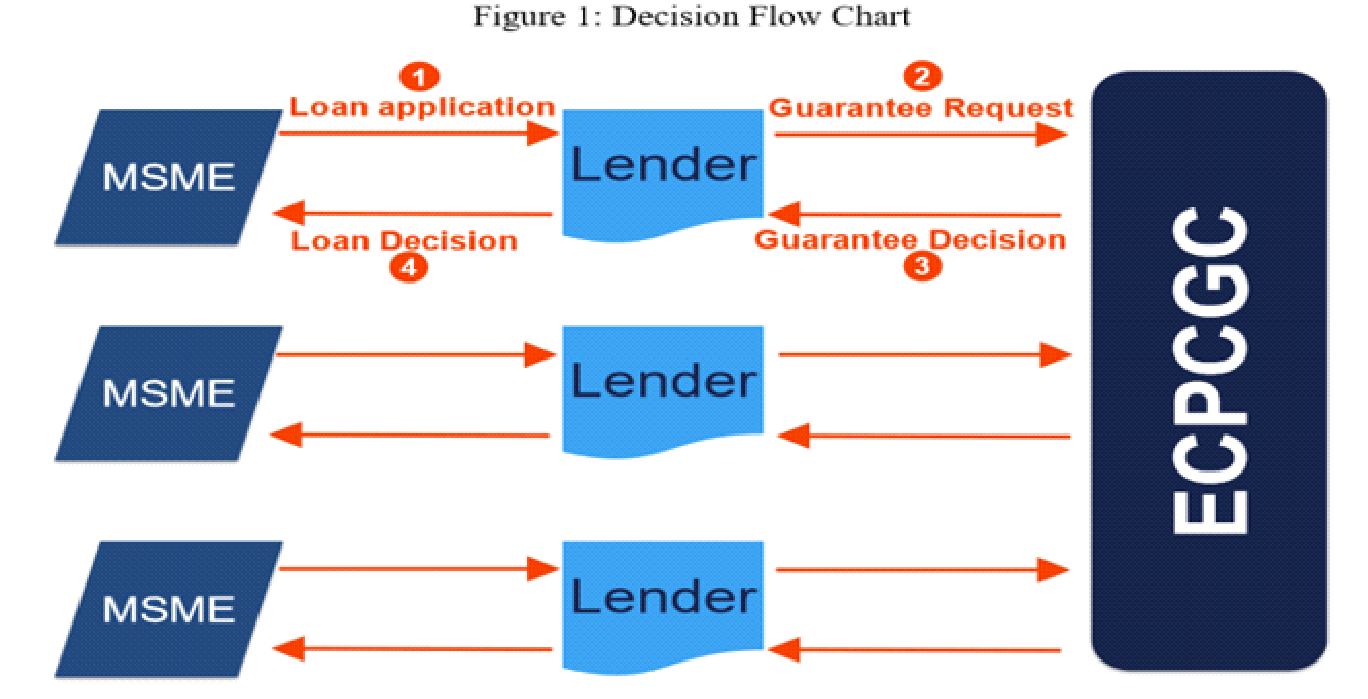

- Owners of MSMEs will apply to their local lender for a loan.

- If the lender is not able to approve the application using the MSME’s conventional credit standards, it may decide to request a guarantee.

- The ECPCGC team will review the application and determine if a guarantee is appropriate.

- The target customer is a business owner who has adequate cash flow to make the loan payments but may not have adequate assets to pledge as collateral, presents more risk than usual or is in an area of business that is relatively new for the lender—such as the creative industries or medical services.

- The lender will collect payments directly from the borrower and will be responsible for liquidating collateral in the event of a default.

- A guarantee fee will be charged, and the proceeds used to help offset any losses absorbed by the Corporation.